Last week, NZX Regulation (NZXR) issued the NZXR Oversight and Engagement Report 2020, available here. The report outlines NZXR's monitoring and oversight activities during 2019 and provides an insight into its enforcement strategy and priorities.

For NZXR's Issuer Compliance team, responsible for administering the Listing Rules and supervising compliance, the focus was heavily weighted towards disclosure practices and compliance with the updated Listing Rules, which fully took effect from 1 July 2019. We expect this focus to continue into 2020.

Issuer investigations

In 2019, Issuer Compliance conducted 202 investigations, up from 96 in 2018. While this is a marked increase, the significant majority of the investigations (135 of 202 or 67%) involved the release of administrative information. Similarly, of the 149 breaches identified in the course of the investigations, 129 were administrative information breaches. As such, NZXR attributes this increase to the implementation of the new NZX Listing Rules, rather than poorer overall market conduct. Consistent with this, in categories other than administrative information, there was an overall reduction in the number of investigations.

NZXR was clear that continuous disclosure remains a priority, in particular in light of continued volatility in global and domestic markets and the performance of issuers. While the number of continuous disclosure investigations declined from 2018 (34, down from 45), said in part to be a reflection of the regulator's ongoing engagement with Issuers in this area and increased Issuer awareness of these obligations, the complexity of these investigations had increased.

NZX Regulation Oversight Engagement Report 2020[1]

Market Participant investigations

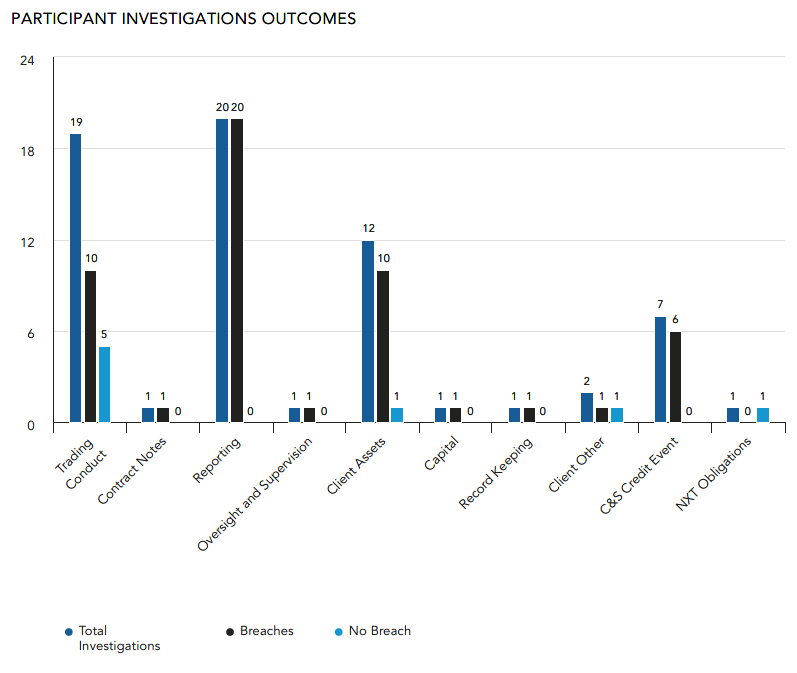

The Participant Compliance team conducted 65 investigations across a broad range of areas, six of which were ongoing as at the end of 2019. As had been the case in 2018, a significant proportion of the investigations related to breaches of reporting obligations (20), closely followed by trading conduct breaches (19). In the 59 completed investigations, 51 breaches were identified, including breaches in all 20 reporting investigations.

NZX Regulation Oversight Engagement Report 2020[2]

Enforcement action

The vast majority of breaches were dealt with by the NZXR using its lower level enforcement tools, including the issuance of a number of obligations letters. The NZXR issued only two Infringement Notices, one to an Issuer and one to a Market Participant. This represents a slight drop from 2018 and 2017, in which five and three notices were issued, respectively.

Ten breaches were referred to the Tribunal, a continuing increase on previous years (three referrals in 2017 and seven in 2017). Of these ten, six related to Issuer conduct and four to Participant conduct:

- four involved breaches of financial reporting obligations and/or disclosure requirements (publication of annual report and disclosure requirements standards);

- two involved breaches of corporate governance rules (rotation of executive directors and independent directors);

- three involved trading conduct (relating to offering Direct Market Access and good broking practise); and

- one related to a breach of clearing and settlement obligations.

In relation to the governance referrals, the report includes a discussion of what NZXR acknowledged had been a widespread misinterpretation by Issuers of the executive director rotation requirements under the 2017 Listing Rules. As a result, NZXR generally did not take further action against the relevant Issuers. However, the report is careful to note that the rules have now been clarified and any future non-compliance will be subject to investigation and enforcement action as appropriate. Based on a referral detailed in the report, that may include censure, financial penalty and costs.

Further details of each of the ten referrals to the Tribunal are set out in the report. Six concluded with a settlement under which the Issuer or Participant was publicly or privately censured and required to pay a penalty of up to $40,000 plus costs. The Tribunal declined to approve a settlement in the other four cases and those matters were, or will be, subject to a Tribunal determination process.

FMA Referrals

In addition to NZXR's own work, 15 matters were referred by NZXR Surveillance to the Financial Markets Authority for further investigation. 13 of these referrals related to potential insider trading and two related to potential market manipulation. No further details about these referrals were provided in the report, but the number of referrals was an increase on 2018 when there were only eight referrals (five in relation to potential insider trading and three in relation to potential market manipulation).