It's been an eventful year in the Restructuring & Insolvency space, so it seems only fitting to continue our annual tradition of sharing a snapshot of key insights and developments from both New Zealand and around the world. Our R&I team also highlights the trends they believe will shape the R&I landscape in 2025.

1 March 2024

Distributions of crypto currencies in insolvent exchange: High Court confirms method of distributions in Cryptopia liquidation

Cryptopia operated a cryptocurrency platform, which was hacked in January 2019. The hack resulted in a loss of 9% of digital assets held in the platform and led to the appointment of liquidators to the company. The liquidators sought guidance from the Court on their proposed distribution process, given an earlier court decision (see here) that Cryptopia held its crypto assets on trust for its account holders. Many of the account holders had not registered their claims in the liquidation. Seeking guidance in this regard reduces the risk of a successful creditor challenge to the liquidators' proposed method of distribution.

The Court approved the process for an interim distribution to be made to encourage account holders to register their claims, with a "soft" cut-off date for registering claims to be set 90 days after the Court's orders (approximately three and a half years since creditors were first able to lodge their claims through a claims portal). The liquidators are entitled to proceed as if any account holders who have not registered their claim in the claims portal prior to the "soft" cut-off date do not exist (although they retain the discretion to accept late claims prior to a "final" cut-off date of 31 December 2024).

The claims portal requires account holders who have registered claims to provide further information, such as payment details and identity verification. Account holders who have not provided this information by the final cut-off date of 31 December 2024 will be treated by the liquidators as having abandoned their claims. The assets in the abandoned accounts will be distributed to account holders who have completed the claims portal process, up to 100% of the account holders' accepted claims. If there are insufficient assets to meet 100% of the accepted claims, the liquidators will be entitled to first apply the assets to reimburse costs charged by the liquidators on a per account basis, and may make a top-up distribution on a pari passu basis in relation to any remaining shortfall.

8 April 2024

High Court determines when an insurance company is insolvent for purposes of voidable transactions regime

The High Court in Johnston v Alpha Insurance a/s (in bankruptcy) held that CBL Insurance Limited's outstanding claims liability (an estimate of an insurer's total likely claims exposure for the cover that it has written) was a due debt for the purposes of determining whether a transaction was voidable under section 292 of the Companies Act 1993. This interpretation significantly widens the test applied by the courts so far.

Insurance and reinsurance companies should account for the "long tail" nature of their liabilities, as policies may cover lengthy durations with an actuarial analysis of probability of claims reflected in the number. By treating the outstanding claims liability as a present accrued liability, courts can determine whether an insurance or reinsurance company is cash flow solvent and able to pay its debts.

12 April 2024

Liquidator has power to appoint liquidators to wholly-owned subsidiaries despite receivership in limited circumstances

In Grant v Bank of New Zealand [2024] NZCA 108, the Court of Appeal held a liquidator could lawfully appoint liquidators to the company's wholly-owned subsidiaries, even though receivers were appointed over the company and its assets (including the shares in question) and the secured creditor had not surrendered its security over the shares of the subsidiaries.

The Court considered the scope of the liquidators' residual discretion under s 254 of the Companies Act 1993 to realise assets subject to a charge (being a secured creditor's interest). That discretion allowed liquidators to exercise powers in limited circumstances, provided that there is no prejudice to the secured creditor and the secured creditor does not intend to realise the secured asset. On a case that turned on its facts, the Court of Appeal found in favour of the liquidators in circumstances where the receivers had indicated that they did not intend to realise value from the shares and held that their appointments did not cause prejudice to the secured creditor's interest in obtaining repayment, on the basis that the shares held no value and no recovery was anticipated.

19 June 2024

English law develops approach to disputed debts where arbitration agreement exists

The Privy Council, on appeal from British Virgin Islands, delivered an important decision on winding-up proceedings where a dispute about the underlying debt is subject to an agreement to arbitrate (Sian Participation Corp (in liquidation) v Halimeda International Ltd). The judgment held that the test for whether a court should exercise its discretion to stay a winding-up application in favour of arbitration is whether the debt relied on by the applicant creditor is "disputed on genuine and substantial grounds". In this case the unpaid debt arose under an agreement with a provision for disputes to be arbitrated. The debt was not genuinely disputed, but a cross-claim was said to exist which must be arbitrated. In this case it was not. This decision overrules an earlier English Court of Appeal decision that directed that a winding-up application should be stayed if the relevant debt is not admitted.

The impact of this decision is yet to be seen in New Zealand (as Privy Council decisions do not strictly bind the New Zealand courts), but it seems broadly consistent with the approach of New Zealand courts when asked to grant a discretionary stay of a liquidation application, without needing to decide the point. The outcome in Sian Participation is also consistent with the Companies Act test for setting aside a statutory demand. Creditors will seek to rely on this authority when faced with a debtor's attempt to refer disputes to arbitration to avoid or delay liquidation.

27 June 2024

Releasing (or not) third party claims in Purdue Pharma

In June, the Supreme Court of the United States issued its much-anticipated ruling in Purdue Pharma. Purdue Pharma – a pharmaceutical company best known for producing OxyContin, contributing to the United States' opioid crisis and attracting over 1,000 lawsuits – filed for Chapter 11 bankruptcy protection in 2019. Purdue's plan of reorganisation proposed to discharge claims owed by the Sackler family to the Purdue estate (including those with respect to negligence, fraud and wilful misconduct) and any present and future opioid-related claims against the Sackler family. In return, the Sackler family would offer US$4.25B into the Purdue estate.

Third party releases are commonly included in restructurings (including by scheme of arrangement) across common law jurisdictions, including for the benefit of directors and advisers involved in a restructuring. In high-profile examples such as the Boy Scouts of America, third party releases have been used to resolve mass tort claims against companies. Proponents argue that it allows claimants swifter and more equitable resolution of their claims. In some cases, such as where the company's directors have a right to indemnification from the company, third party releases are necessary to ensure that the company's assets are not depleted by the pursuit of claims against directors.

In Purdue, the majority of the Supreme Court found that, subject to exceptions in the case of asbestos claims (which have been specifically legislated for), Chapter 11 does not authorise the discharge of such claims against non-debtors without the consent of affected claimants in circumstances where the non-debtors had not filed for bankruptcy or placed their assets on the table for distribution to creditors.

14 August 2024

NZ central bank begins easing of monetary policy by cutting OCR

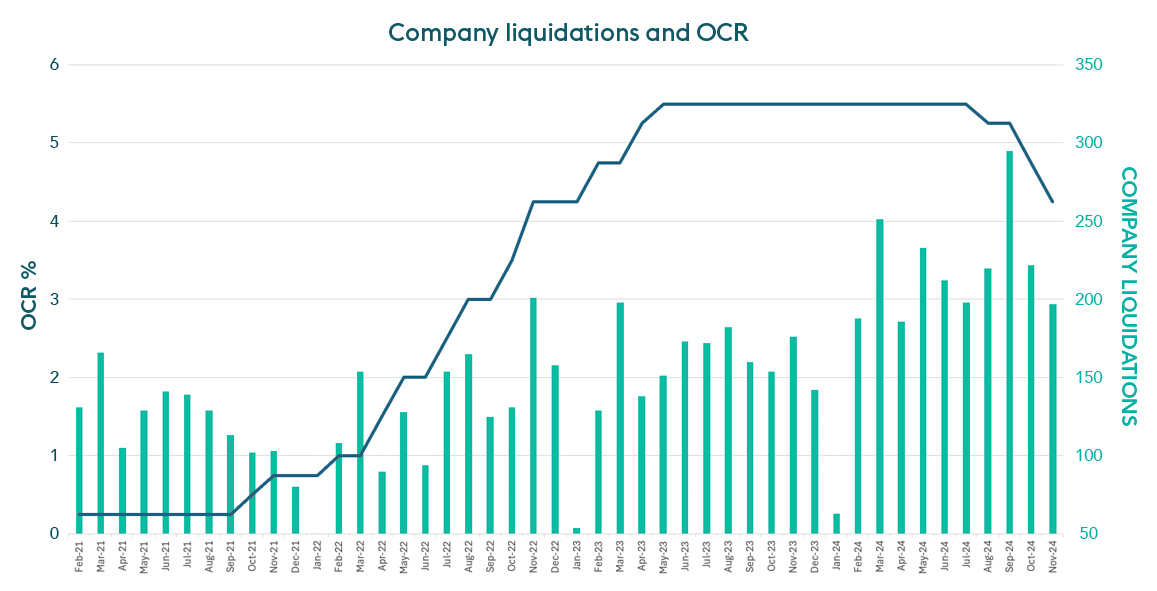

The RBNZ has started cutting the OCR, first by 25bp in August, then 50bp in October, followed by 50bp in November, with the OCR now sitting at 4.25%, its lowest level in 18 months. With insolvency statistics of late making ugly reading (as demonstrated below), this easing cycle has been welcomed by many – but has it come too late for some (with liquidations up 25% year on year)?

21 August 2024

Du Val group placed into statutory management

At 6pm on 21 August 2024, John Fisk, Stephen White and Lara Bennett of PwC New Zealand were appointed by the Crown (on the recommendation of the FMA) under section 38 of the Corporations (Investigation and Management) Act 1989 as statutory managers of 70 entities associated with the Du Val property development group.

Statutory management suspended the initial receivership appointments across the Du Val entities that were made on 2 August 2024. Statutory management is an option of last resort which is used infrequently in complex insolvencies where a company / group of companies is, or may be, operating fraudulently or recklessly, and it is desirable that statutory managers be appointed to limit the risk of further deterioration in the financial position of the company, to limit or prevent fraudulent activity being carried out and/or to enable the affairs of the company to be dealt with in a more orderly or expeditious way.

This is a significant Crown power that is unique to New Zealand. It is sparingly used and the last time it was notably used was in the failure of Alan Hubbard's Aorangi Securities Limited and associated entities.

5 September 2024

NZICA Disciplinary Tribunal cancels licence of Licensed Insolvency Practitioner

An NZICA disciplinary tribunal has taken the rare step of cancelling the licence of a Licensed Insolvency Practitioner ("LIP") under the Insolvency Practitioners Regulation Act 2019 ("IPRA"), finding that Kelera Nayacakalou was guilty of misconduct for contracting insolvency services out to a company operated by an unlicensed practitioner once convicted for tax fraud and finding that no penalty short of cancellation was available given the extent of the LIP's failures.

The basis for the findings included that the LIP had entered into this arrangement without conducting any due diligence on the unlicensed practitioner or adequately supervising (or even meeting) him or his team and allowing excessive fees to be charged on the liquidations. The Tribunal characterised this as a complete dereliction of the LIP's duty under IPRA and a failure to act in accordance with relevant standards for insolvency engagements and professional obligations.

26 September 2024

Creditors successful in direct claims for compensation against directors

In 2023 the Supreme Court confirmed in the Mainzeal decision that section 301 of the Companies Act could be used for direct claims by creditors against directors for losses suffered as a result of breach of director duties.

This was recently used by a creditor in Boaden v Mahoney [2024] NZHC 2783. The High Court ordered the director of Civil Underground Limited (in liquidation) to pay compensation of $89,400 to the creditor under section 301 for direct losses suffered as a result of the director's breach of the reckless trading duty (section 135) and the duty in relation to incurring obligations (section 136).

Directors should be aware that they must increasingly take creditors' interests into account as the company nears insolvency. In Kumar v Smartpay Ltd [2023] NZCA 410, the Court of Appeal found that, once the reckless trading duty has been triggered, directors must have significant regard for the interests of creditors, moving towards paramountcy as the company gets closer to insolvent liquidation. As the financial affairs of a company deteriorate, the economic stake that the creditors have in the company's residual asset increases. These principles have been a hot topic of discussion since the Sequana decision – read more on that topic here.

Similarly, the High Court in England and Wales recently ordered former directors of a department store (British Home Stores) to pay £110 million to creditors for breach of the equivalent duties in the United Kingdom.

30 September 2024

Increase in priority amount for employee preferential claim cap

On 30 August 2024, the maximum amount for preferential payments to employee creditors in a liquidation scenario increased from $25,480 to $31,820 under the Companies (Maximum Priority Amount) Order 2024, which amends Schedule 7 of the Companies Act 1993.

3 October 2024

NZ IPs are eligible for automatic registration in Australia

In October, ASIC confirmed that New Zealand-registered insolvency practitioners are eligible for automatic registration in Australia under the Trans-Tasman Mutual Recognition Act 1997. New Zealand-registered practitioners can become registered in Australia by notifying ASIC of their New Zealand registration.

17 October 2024

Court of Appeal reverses equitable lien protection for purchasers in a tiny home context

The Court of Appeal recently clarified the rights of purchasers of partially completed tiny homes, removing the uncertainty created by equitable liens of this type in New Zealand and removing their priority on insolvency. The Court's finding that security interests under the PPSA take priority over this type of equitable lien provides liquidators and creditors alike with much needed certainty and confirms that secured creditors will retain priority in the case of insolvency in accordance with established principles. See our article here.

Looking ahead to 2025

- Companies Act review: Minister Bayly has announced a two phased review of the Companies Act to (1) modernise the "out-of-date" Act, simplify compliance requirements, and deter poor and illegal business practices (a Bill is expected early 2025) and (2) review the directors’ duties provisions and related issues of director liability, sanctions and enforcement more generally (during 2025). More information about the Companies Act reforms can be found in our article here.

- Geopolitical and economic uncertainty: The impact on the New Zealand economy of the changing trade policies following the presidential election in the United States, ongoing conflict in Ukraine and the Middle East, and challenges with the Chinese economy will continue into 2025.

- Continued growth in private credit: Whilst private credit plays a critical role in the European and American economies, it is still a developing market in New Zealand. We anticipate that New Zealand will continue to feel the benefits of the growth of private and alternative capital in Asia and Australia over the next 12 months, providing more options and flexibility for borrowers and restructuring opportunities at this stage of the current economic cycle.

- Cyber response: Cyber-attacks and outages can have many devastating impacts, as evidenced by the global impact that the CrowdStrike outage had in July 2024, halting the operations of numerous airlines, banks, hospitals, supermarkets, emergency services, critical infrastructure providers and businesses the world over. We expect further event-driven distress in businesses caused by cyber incidents in 2025 and beyond, similar to that which was experienced by Cryptopia in New Zealand leading to its insolvency in 2019. Keep up to date with our insights here.

This content is intended only to provide a summary of the subject covered. It does not purport to be comprehensive or to provide legal advice. No person should act in reliance on any statement contained in this publication without first obtaining specific professional advice. If you require any advice or further information on the subject matter, please contact a Russell McVeagh partner/solicitor.