Submissions close on 23 October in the next round of consultation by Treasury and the Reserve Bank on the prudential framework for deposit takers and depositor protection. In this first article in our Deposit Takers Reform series, we focus on chapter 3 of the consultation document – the regulatory perimeter, and we'll discuss other chapters in future articles of the series. In the meantime, please contact one of our experts if you wish to discuss any aspects of the proposals in the consultation document. You can view this document at the link here.

Background

Phase 1 of the Reserve Bank Act review, which saw amendments made to the Reserve Bank's monetary policy framework, was completed in 2018. Phase 2 is concerned with the Reserve Bank's financial policy framework and overall governance.

Cabinet's in-principle decisions on Phase 2, following initial consultations, have resulted in:

-

an "institutional bill" being introduced to Parliament (to give effect to decisions on the Reserve Bank's institutional form); and

-

the decision to replace the two separate registered bank and licensed Non-Bank Deposit Takers (NBDT) frameworks with one integrated licensed deposit taker framework.

The new deposit taker framework would:

-

have an activity-based definition of deposit taker, to apply to persons in the business of borrowing and lending;

-

be regulated by the Reserve Bank under one piece of legislation – a Deposit Takers Act;

-

retain restrictions on the use of words such as "bank" and "banking"; and

-

provide for a risk-based licensing and regulatory framework.

Regulatory Perimeter Proposals

Types of firms

The regulatory perimeter defines the types of firms that will be subject to the Deposit Takers Act. If a firm is a deposit taker, it will be required to be licensed and will be subject to prudential regulation by the Reserve Bank under the Deposit Takers Act. The level of regulation to which a licensed deposit taker would be subject would reflect the nature and scale of their activities and the risk they pose to the financial system. Deposits made with licensed deposit takers will be protected under the proposed deposit insurance scheme, up to a total of $50,000 per depositor, per deposit taker.

The consultation paper proposes that all persons that carry on the business of borrowing and lending should be required to be licenced under the Act. The proposed exception to this is wholesale funded non-bank lenders whose New Zealand business does not exceed a prescribed size threshold. To us, this relatively simple activity-based test is a sensible starting point for the new deposit takers regime. There is unlikely to be much dispute regarding the core participants in this sector, ie NZ banks and NBDTs, but there will be a variety of views on who else should be included and what level of regulation should apply to different participants. Limiting the test to borrowing and lending will avoid the complication that arises for firms under the NBDT Act who do not lend but instead provide financial services.

Territorial scope

The proposed territorial scope would mean that the definition applies only to firms that borrow in New Zealand. No similar limitation is proposed for the lending element of the definition. The consultation paper proposes that borrowing could mean issuing debt securities as defined in the FMC Act; and lending could mean providing credit under a credit contract as defined in the CCCF Act. Including an explicit territoriality provision would be an improvement on the approach taken in the NBDT Act.

Using the words "bank" and "deposit"

Use of the words "bank" and "deposit" (and related words) would be restricted if they are used by financial service providers who are not licensed deposit takers. This would be the mechanism by which branches of overseas banks that do not borrow money in New Zealand would become subject to the Deposit Takers Act.

The consultation paper is seeking views on whether there should be any other restrictions on the use of the word "bank" (and related words) in a licensed deposit taker's name. For instance, should any licensed deposit taker be entitled to call themselves a bank, or should its use be restricted to certain types of deposit taker, such as those who are subject to the highest level of prudential regulation?

Issue of uninsured debt

The consultation paper is seeking views on whether finance companies could issue uninsured debt securities to retail investors. If this was permitted, these firms would have a separate restricted licence and would not be categorised as licensed deposit takers. Measures would need to be put in place so that retail investors could clearly distinguish between insured deposits issued by licensed deposit takers and uninsured debt securities issued by restricted licence holders. Restricted licence holders would not be entitled to concessions that would be available to licensed deposit takers, such as relief from parts of the FMC Act.

Flexibility for the Reserve Bank

The consultation paper is proposing that the new regime has sufficient flexibility to enable the Reserve Bank to grant exemptions in appropriate circumstances and to designate entities as deposit takers if their activities in substance are the same as borrowing and lending.

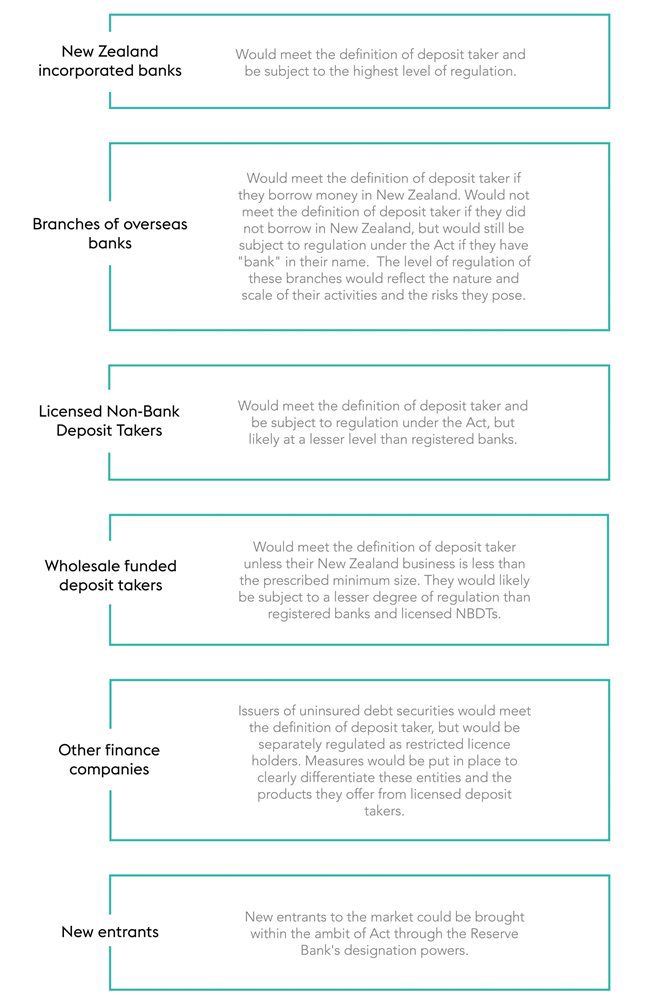

So what would this mean for registered banks, licensed NBDTs and other participants in New Zealand's finance industry?

Possible outcomes under the Deposit Takers Act for different types of firms is set out below:

In the next article in our Deposit Takers Reform series, we will discuss Chapter 5 of the consultation paper: Liability and accountability.